Either a rebound or a breakout imminent on France 40 Index

France 40 Index is heading towards a line of 5803.7998. If this movement continues, we expect the price of France 40 Index to test 5803.7998 within the next 21 hours. But don’t be so quick to trade, it has tested this line numerous times in the past, so this movement could be short-lived and end […]

Either a rebound or a breakout imminent on Germany 30 Index

Germany 30 Index is heading towards the support line of a Descending Triangle. If this movement continues, we expect the price of Germany 30 Index to test 13852.5000 within the next 3 days. But don’t be so quick to trade, it has tested this line numerous times in the past, so this movement could be […]

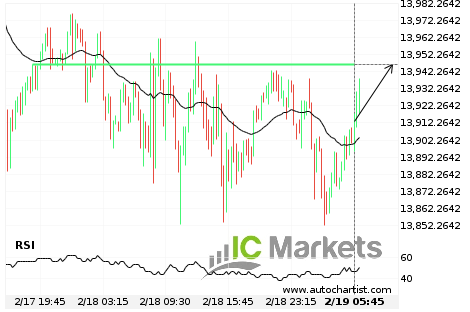

Should we expect a breakout or a rebound on Germany 30 Index?

The movement of Germany 30 Index towards 13946.2002 price line is yet another test of the line it reached numerous times in the past. We expect this line test to happen in the next 8 hours, but it is uncertain whether it will result in a breakout through this line, or simply rebound back to […]

Will Germany 30 Index have enough momentum to break support?

Germany 30 Index is heading towards the support line of a Channel Down and could reach this point within the next 7 hours. It has tested this line numerous times in the past, and this time could be no different from the past, ending in a rebound instead of a breakout. If the breakout doesn’t […]

Where is Italy 40 Index moving to?

After posting 5 consecutive bearish candles in 2 days, you may start considering where Italy 40 Index is heading next, a continuation of the current downward trend, or a reversal in the previous direction.

What’s going on with Japan 225 Index?

Those of you that are trend followers are probably eagerly watching Japan 225 Index to see if its latest 3.99% move continues. If not, the mean-reversion people out there will be delighted to cash in on this exceptionally large 4 days move.

UK 100 Index is on its way up

UK 100 Index has experienced an exceptionally large movement higher by 2.03% from 6,506.75 to 6,636.55 in the last 3 days.

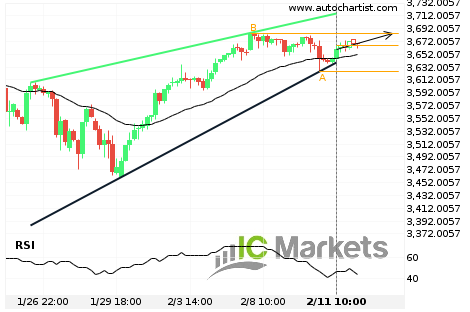

Breach of resistance line imminent by EU Stocks 50 Index

EU Stocks 50 Index is moving towards the resistance line of a Rising Wedge which it has tested numerous times in the past. We have seen it retrace from this line before, so at this stage it isn’t clear whether it will breach this line or rebound as it did before. If EU Stocks 50 […]

A start of a bearish trend on Germany 30 Index

Germany 30 Index has broken through a support line of a Triangle chart pattern. If this breakout holds true, we expect the price of Germany 30 Index to test 13719.6175 within the next 2 days. But don’t be so quick to trade, it has tested this line in the past, so you should probably confirm […]

Breach of resistance line imminent by Germany 30 Index

Germany 30 Index is moving towards the resistance line of a Channel Up which it has tested numerous times in the past. We have seen it retrace from this line before, so at this stage it isn’t clear whether it will breach this line or rebound as it did before. If Germany 30 Index continues […]